Forecasting the Volatility of Altcoins

We put forward a model implementation for unbiased forecasts of cryptocurrency volatility. The model provides a familiar breakdown between common and instrument-specific sources of variance. Within the common factors, we attempt to build a digital asset-specific multi-factor framework. We also incorporate an autoregressive adjustment to account for heteroskedasticity in daily returns. The model performs well over its short history and can be used for construction of diversified token portfolios.

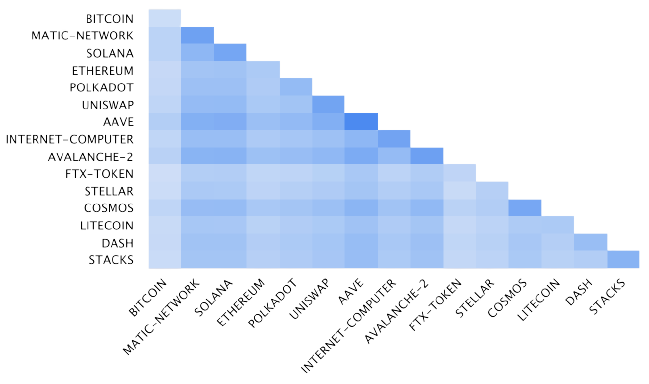

Covariance of Token Return

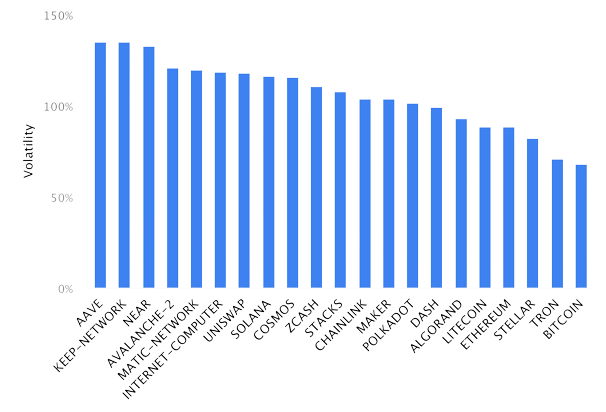

Cryptocurrency returns exhibit a high degree of correlation to one another and there are large differences in the level of volatility of the different tokens. These differences are mostly persistent over time.

Covariance Matrix of Daily Returns

Annualized Volatility of Daily Returns

We estimate a model that decomposes the covariance matrix of the top 200 tokens between common and residual variance in the form:

Sources of Correlation

Systemic Risk

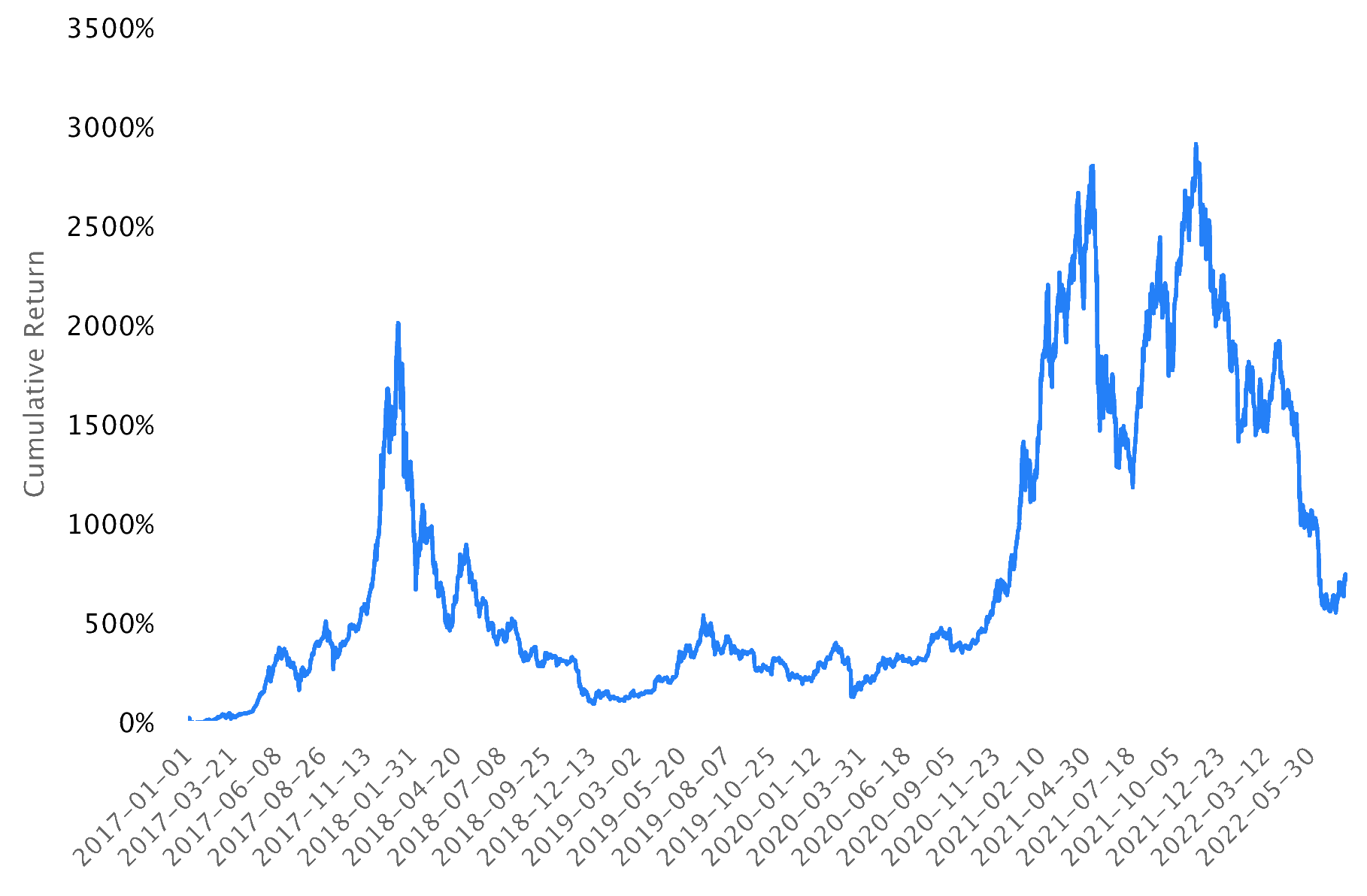

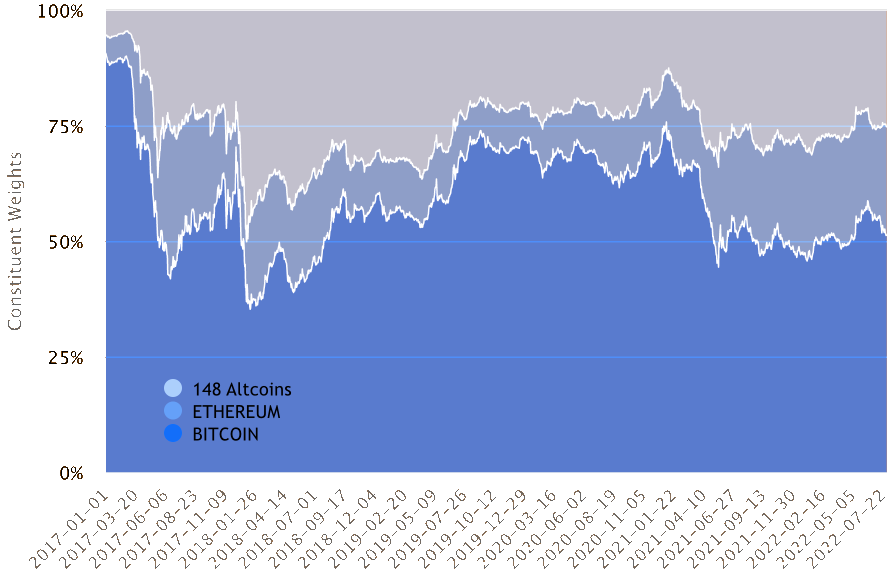

To capture a measure of systemic risk in crypto market, we construct a quarterly rebalanced index of market cap weighted token. This approach recognizes the large importance to Bitcoin as a proxy for systemic risk in crypto, while still capturing diversification benefits of allocating to Altcoins. The index most closely resembles the Bloomberg Galaxy Crypto Index.

Market Benchmark Return

Benchmark Constituents

Crypto Sectors

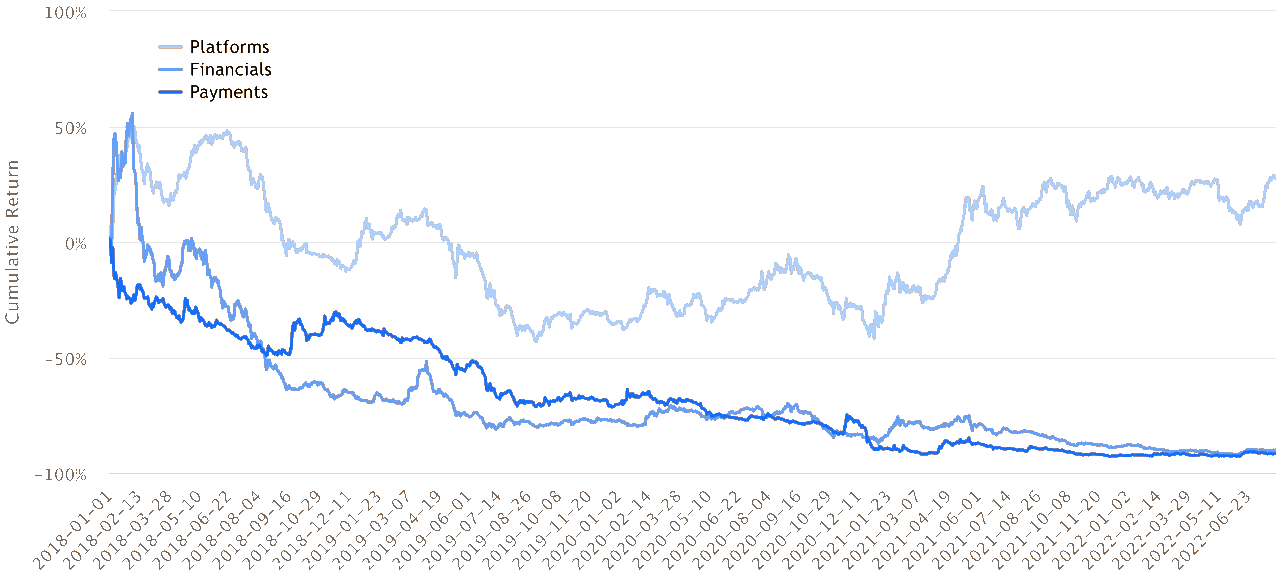

After accounting for systemic risk, there are still observable co-movements in token returns. The most evident is related to tokens with common “use cases” – or equivalent to “sectors” in the stock market.

We classified cryptocurrencies into a fundamental taxonomy that grouped tokens by value driver. From that classification we constructed several sector factors and retained the ones that displayed then most robust data quality for a sufficiently long history.

These common factors together account for roughly 50% of token variance.

Sector Returns (Net of Benchmark)

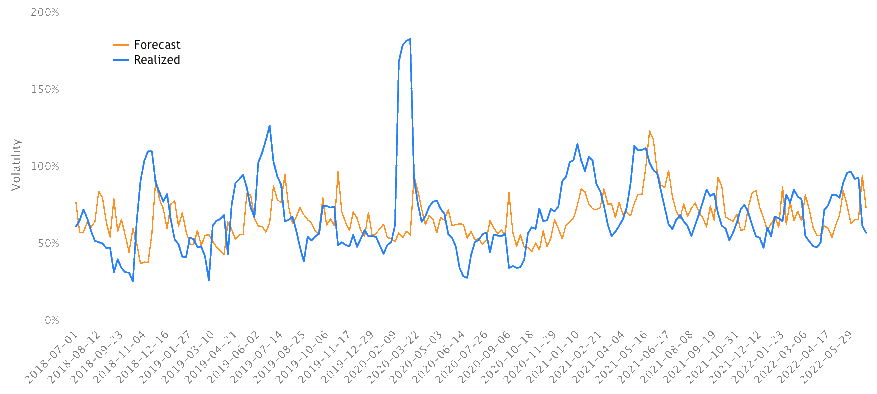

Conditional Volatility in Crypto

There’s a vast literature on conditional volatility models for digital assets. The autoregressive behavior of daily returns is still very much in place at the time of writing and so we’ve accounted for this in the model estimation.

Token autocorrelation from 2018 to 2022

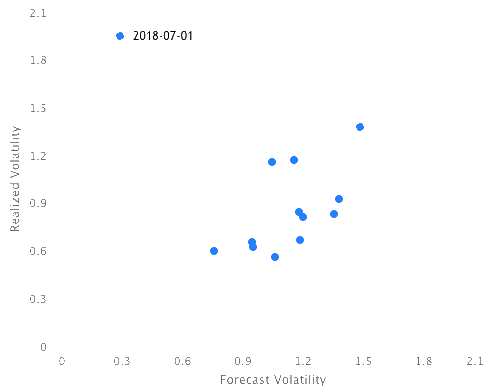

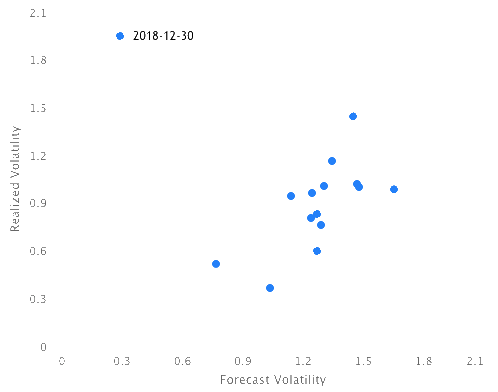

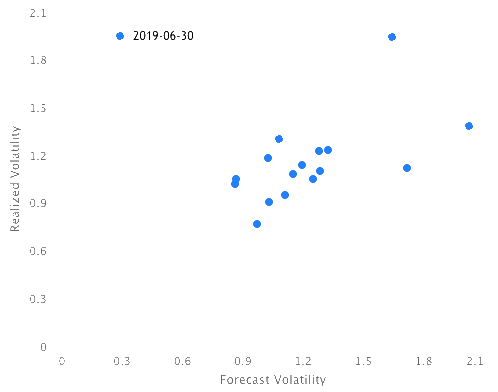

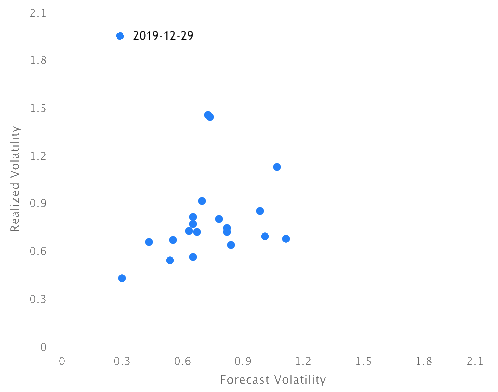

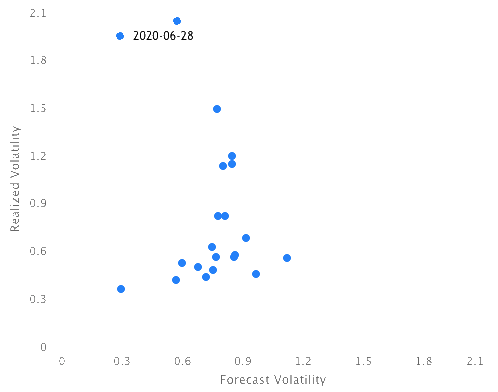

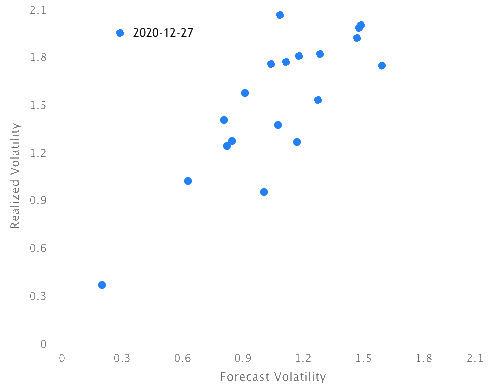

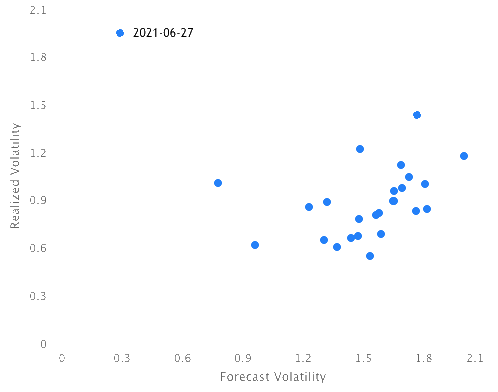

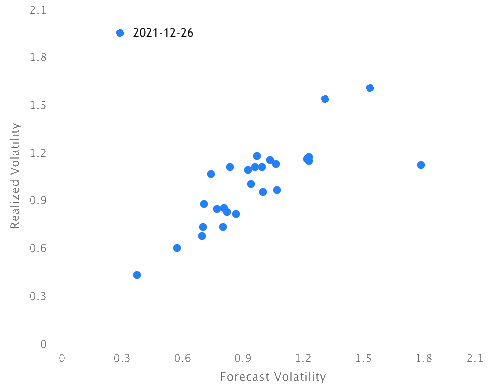

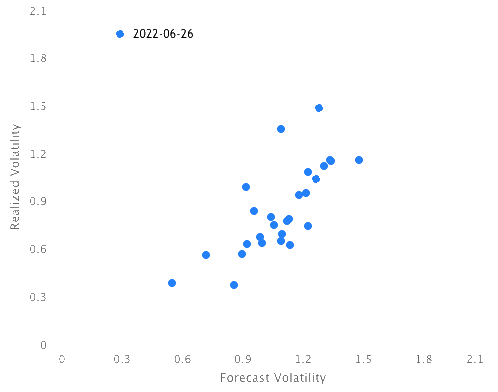

Model Performance

The model provides an unbiased estimation of crypto volatility, even over the recent downturn.

Bitcoin Volatility

On average the model explains 56% of the cross-section of token volatility over the last 4 years.

Estimated Model via API

QIS Risk provides model parameters via an easy-to-use API. We also make this data available as flat file for rapid backtesting. Contact us on support@qisrisk.com for a data export.

Further Reading

Smales (2020) One cryptocurrency to explain them all? Understanding the importance of bitcoin in cryptocurrency returns

Shah et al (2021) Principal component analysis based construction and evaluation of cryptocurrency index

Dyhrberg (2016) Bitcoin, gold and the dollar – A GARCH volatility analysis

Liu et al (2019) Factor Structure in Cryptocurrency Return and Volatility

Ardia et al (2018) Regime changes in Bitcoin GARCH volatility dynamics

Corbet et al. (2017) The influence of central bank monetary policy announcements on cryptocurrency return volatility

Aras (2021) Stacking hybrid GARCH models for forecasting Bitcoin volatility

Frances et al (2019) The cryptocurrency market: A network analysis

Bhambhwani et al (2020) Blockchain Characteristics and the Cross-Section of Cryptocurrency Returns